Intermediate accounting j david spiceland – Intermediate Accounting: A Comprehensive Guide by J. David Spiceland is an authoritative and comprehensive textbook that provides a thorough understanding of the principles and practices of intermediate accounting. This book is designed for students pursuing a deeper understanding of accounting concepts and their application in real-world business scenarios.

The book covers a wide range of topics, including financial statement analysis, time value of money, inventory accounting, long-term assets, liabilities, equity, consolidated financial statements, and financial reporting and disclosure. Each chapter is meticulously structured to present complex accounting concepts in a clear and accessible manner, making it an invaluable resource for students and professionals alike.

Introduction

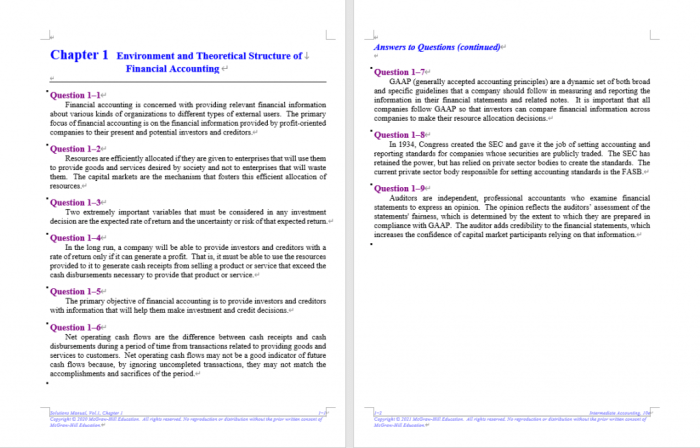

Intermediate accounting focuses on providing financial information to external users, such as investors and creditors. It provides a comprehensive understanding of the financial reporting process and the underlying concepts and principles that guide the preparation of financial statements.

Key concepts in intermediate accounting include the accrual basis of accounting, the matching principle, and the going concern assumption. These principles ensure that financial statements accurately reflect a company’s financial performance and position.

Financial Statement Analysis

Financial statement analysis involves examining a company’s financial statements to assess its financial health and performance. It helps users make informed decisions about investing in or lending to a company.

Common methods of financial statement analysis include:

- Horizontal analysis

- Vertical analysis

- Ratio analysis

- Trend analysis

| Method | Purpose | Advantages | Disadvantages |

|---|---|---|---|

| Horizontal Analysis | Compares financial data over time | Identifies trends and changes | Can be misleading if there are significant changes in the company’s operations |

| Vertical Analysis | Compares financial data to a base amount | Shows the relative importance of different line items | Can be misleading if the base amount is not representative |

| Ratio Analysis | Calculates ratios to assess different aspects of a company’s financial performance | Provides insights into liquidity, profitability, and solvency | Can be difficult to interpret if the ratios are not used in context |

| Trend Analysis | Examines financial data over several periods | Identifies long-term trends and patterns | Can be difficult to identify short-term changes |

Time Value of Money

The time value of money (TVM) is the concept that money has a different value at different points in time. This is due to the fact that money can earn interest over time, so a dollar today is worth more than a dollar in the future.

TVM is used in accounting to calculate the present value and future value of cash flows. This is important for making financial decisions, such as evaluating investment opportunities and determining the cost of borrowing.

The formula for calculating the present value of a future cash flow is:

PV = FV / (1 + r)^n

where:

- PV is the present value

- FV is the future value

- r is the interest rate

- n is the number of periods

The following flowchart illustrates the process of calculating the present value of a future cash flow:

[Flowchart yang menggambarkan proses penghitungan nilai sekarang dari arus kas masa depan]

Detailed FAQs: Intermediate Accounting J David Spiceland

What are the key features of Intermediate Accounting: A Comprehensive Guide by J. David Spiceland?

Intermediate Accounting: A Comprehensive Guide by J. David Spiceland is known for its clear and concise explanations, comprehensive coverage of topics, and practical examples that illustrate the application of accounting concepts in real-world business scenarios.

Who is the target audience for Intermediate Accounting: A Comprehensive Guide by J. David Spiceland?

This book is primarily designed for students pursuing a deeper understanding of intermediate accounting concepts. It is also a valuable resource for professionals seeking to enhance their knowledge and skills in this field.

What are the benefits of using Intermediate Accounting: A Comprehensive Guide by J. David Spiceland?

This book provides a solid foundation in intermediate accounting principles and practices, enabling readers to develop a thorough understanding of the subject matter. It also helps readers develop critical thinking and analytical skills essential for success in the field of accounting.